What you can learn from how Greggs is growing capability in food-to-go

- Gavin Rothwell

- Mar 19, 2024

- 4 min read

Greggs is a long-standing success story in food-to-go and its latest results (sales up 19.6% to £1,810m) show how it continues to evolve and adapt to prevailing trends across the market. We look at the key trends called out by Greggs in its recent full year update, explore how they apply to the broader food-to-go market opportunity and identify the opportunities for other food-to-go operators.

Making the most of the breakfast opportunity... and meeting more missions across the day

Greggs has enjoyed phenomenal success in targeting the breakfast mission, establishing destination status and now claiming a share of 19.6% of visits in this market, according to Circana. The value proposition at Greggs has long been a strength, and works particular well at breakfast, and the meal deal mechanics it employs help drive destination status. We’d encourage operators to ask themselves first of all if they have the footfall and the capability to deliver the right proposition for this mission. And the second question is then to consider whether they could develop this, based on factors including existing brand strengths, team member capacity and production capability.

Breakfast won’t be right for everyone, but the focus on meeting multiple missions throughout the day retains broad relevance. Stretching thinking to include the idea of shoulder missions around key day parts is well worth considering for any food-to-go business. We’d suggest thinking about five or six different dayparts when considering the broader opportunity and when developing and updating the core menu and proposition. And this emphasis is particularly important around travel locations.

How to build evening trade

Our experience and knowledge of food-to-go operations across Europe and North America indicates to us that the most likely route to success here is ensuring the lunchtime offer remains, or evolves to become, very relevant for evening trade. Greggs has had a deliberate longer term focus here that we think others can learn from.

We’ve seen that this mission is not an easy one to take advantage of, but, with the right fundamentals in place, there is an opportunity to do more here. Hot food is likely, for most, to play a key role, but the type of hot food needs to be carefully considered and aligned to the core customer groups and missions.

Across the market, Greggs believes that 35% of food on the go missions are after 4pm. As well as offering the right menu, effective communication of extended opening hours – and ensuring good availability over those extended hours - also play an important part in developing this. Of course, good availability at 6pm might not be defined in the same way as good availability at 12pm, but setting out what good looks like across key day parts is an important first step.

Harnessing delivery

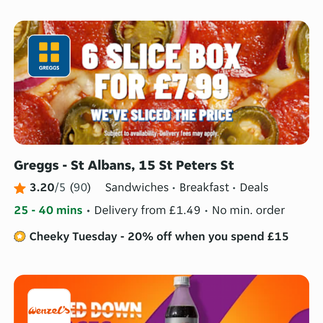

Linked to the expansion of evening trading, the development of delivery has also been significant for Greggs. It’s currently over 8% of total sales, clearly with the evening opening supporting growth. Family pizza boxes were cited as one example of how Greggs is evolving to play more strongly in this space, but also numerous bundle deals, designed for sharing and across the different dayparts, support this more broadly. Greggs called out, perhaps unsurprisingly, that its hot food offer had been integral to the impressive 23.6% growth within its delivery operation over the past year. It also called out how this has been supported by more Greggs outlets offering delivery - almost 1,500 at the end of 2023.

Exploring forecourt and franchising opportunities

Roadside development and franchising are two areas that are attracting a lot of interest from a wide range of operators right now. There’s a lot to take from the Greggs approach in each area. From the franchising perspective, Greggs is widely seen to do a great job in supporting new franchisees and helping them to both launch and develop. From a roadside perspective, there’s a lot of opportunity for a wide range of operators. Yes, it’s easier with a nationally recognised brand name over the door, but there’s scope for more operator brands to become nationally – or at least regionally renowned. We’re supporting several business right now with insights around future roadside opportunities – get in touch to find out how we can help you here. As for Greggs, around 40% of its openings in 2023 were roadside, and Greggs sees roadside as a key component of its store estate expansion. Our advice to operators is to act – or at least understand the dynamics of the market – sooner rather than later.

Building partnerships & concessions

The evolution and raised ambition across supermarkets and the shift among non-food retailers to drive greater dwell time and a deeper experience are both evident in the evolution of Greggs here. More stores in Sainsbury’s and Tesco supermarkets seem assured, while the collaboration with Primark appears to be going from strength to strength. The evolution of food-to-go propositions in supermarkets is already well under way –based on what we're seeing globally, we see a lot more opportunity to go for. Our focus is on raising the ceiling of potential for our clients.

Understanding the rising importance of loyalty schemes

Our key messages to any food-to-go operator are don’t be left behind on loyalty and make sure your loyalty play works towards your business goals. Despite what could be seen as a relatively late start, Greggs is increasingly harnessing the power of its loyalty scheme. This encompassed 12.6% of transactions over the year, up from 6.2% the year before, with the key take out being that customers who engage, shop more frequently. Personalised communications and offers also represent a major component of what Greggs is doing here, important in driving relevance, while every ninth purchase unlocks a free 10th one, important in driving frequency of visit and brand stickiness. The relevance and simplicity points are ultimately key to delivering brand stickiness and increasing frequency of visit. There’s also a critical consideration around who you’re targeting and who you’re not. It’s very difficult to create something that will appeal to 100% of your customer base.

Supporting your strategic development

Do you want to bring your team up to speed with the changing food-to-go opportunity? We can support this through a range of solutions including market briefings, food-to-go safaris and workshops – get in touch to find out more about how we can support your food-to-go growth.

Comments